Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice.

The cryptocurrency market has garnered a reputation for being volatile, and stablecoins have emerged as a solution to temper the unsteadiness. Stablecoins offer a lot and can be viewed as a buffer between traditional fiat and digital assets. What are stablecoins and do they have the power to transform the financial ecosystem we see now into one more with stability?

Table of Contents

- Stablecoins – What are They and What Do They Do?

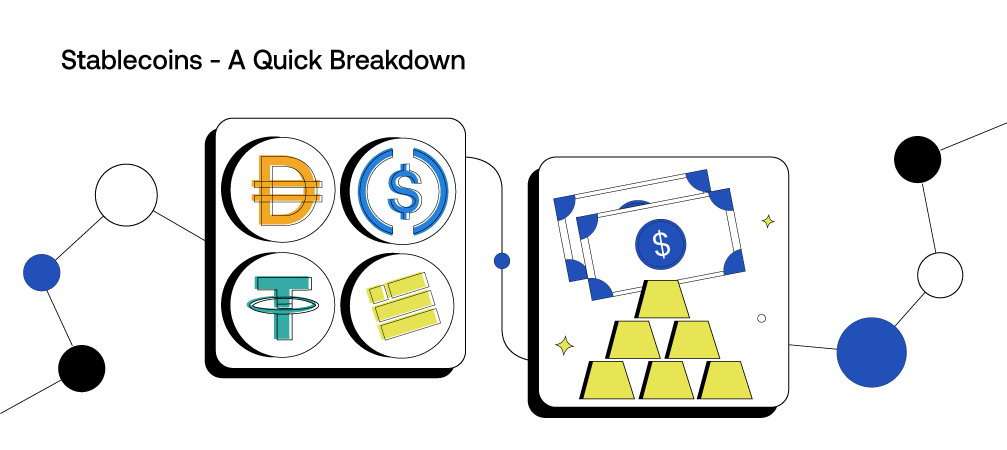

Stablecoins – A Quick Breakdown

The name gives it away. Stablecoins are designed to counter volatile cryptocurrencies with price stability. How? They do it by “pegging” (tying or linking) their value to a stable asset, usually fiat currency like the U.S. dollar. There are also gold-backed stablecoins, which are tied to commodities and not fiat currencies.

Stablecoins are backed by many things and there are different types of stablecoins, which we will get into in a bit.

Why are Stablecoins Important?

Stablecoins can help promote financial inclusion for people around the world. They also bring many other benefits to the table.

What is Their Purpose?

The two most essential functions of stablecoins are providing a stable price in a fluctuating market, and serving as a bridge between fiat and digital currency.

There are also other components as well such as opening doors for countries and populations globally that do not have access to stable markets to gain more opportunities using the stablecoins to transact, save and invest.

Cross-border transactions are sped up and made easier. Because of blockchain technology, you can expect lower fees and faster speeds without the need to rely on middlemen. Stablecoins also play a prominent role in decentralized finance (DeFi). They are looked at as the stable value in a market of volatility.

How Do Stablecoins Work?

The inner workings of stablecoins can get a bit complicated, but we broke it down into bite-sized pieces:

- Pegged asset selection – Stablecoin projects will choose what asset to tie it to. It can be a fiat currency or a commodity.

- Algorithmic or collateralization mechanism – Then comes the decision of the type of stablecoin. They can either be algorithmic or collateralized, which we will also cover in more detail.

- Mint and issuance – Once the above steps have been determined and there is collateral, stablecoins are minted and issued to users.

- Peg maintenance – The stablecoin project will keep up the stablecoin’s value in accordance with the collateral or algorithms. The system will monitor collateralized stablecoins and adjust the supply and ratio to maintain their value. Algorithms will consider market conditions and adjust the supply as needed.

- Redemption – Users can return their stablecoins to the system and redeem collateral that is the equivalent of their pegged value.

- Audit transparency – In order to gain trust in whatever platform it’s operating in, stablecoin projects provide complete transparency and conduct regular audits.

Types of Stablecoins

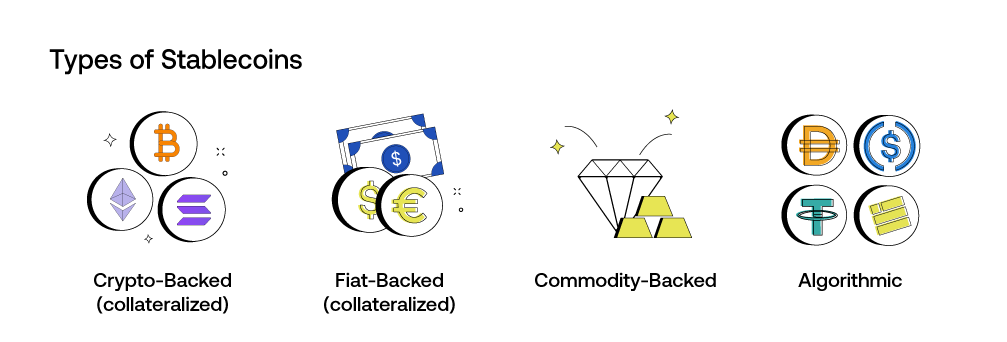

- Crypto-Backed Stablecoins (collateralized)

These types of stablecoins are the ones that are collateralized by cryptocurrency. This means that crypto assets are held as collateral for these stablecoins. This type of collateralization occurs on the blockchain through smart contracts. - Fiat-Backed Stablecoins (collateralized)

Alternatively, fiat currencies such as the U.S. dollar can also be used as collateral. These reserves are typically held in a traditional financial institution, which makes them more centralized. Stablecoins backed by fiat aim to maintain a 1:1 ratio between their value and the collateral. - Commodity-Backed Stablecoins

Commodity-backed stablecoins are the ones that we mentioned can be pegged to gold. However, it doesn’t have to be gold and can also be pegged to real-world commodities such as silver and other precious metals. - Algorithmic Stablecoins

Algorithmic stablecoin options are ones that do not depend on any collateral. Instead, algorithms are used to determine and manage the stablecoins. They monitor the supply and demand and adjust to maintain balance.

USDC, USDT, DAI, and BUSD are all examples of popular stablecoins that have gained popularity and the trust of the crypto community.

Conclusion

In an industry that still has tentative footing, stablecoins have emerged to offer stability and reliability. It seeks to establish the much-needed bridge between traditional finance and the burgeoning cryptocurrency market. Will the stablecoin market be the ultimate solution for offsetting the volatility in the financial ecosystem we see right now? Not yet, but right now they seem to be a constant when the market price falls.

Related Articles:

- What are Altcoins?The Alternative to Bitcoin

- Binance USA and Coinbase VS the SEC

- Top 10 Most Eco-Friendly Crypto Options in 2023