It’s simple: the ERC-20 protocol improves interoperability and greatly widens the accessible use cases of blockchain assets.

You may have heard of Ethereum, but did you know its assets are divided into a number of asset protocols that define how they work?

Table of Contents

- What is Ethereum, and where did it come from?

- The initial Ethereum development team

- The ERC-20 Protocol

- ERC-20 protocol: Smart contracts

- NFTs on the Ethereum blockchain

- DeFi on the Ethereum blockchain

- Accessing the ERC-20 protocol on SecuXess

What is Ethereum, and where did it come from?

Ethereum is a decentralized, open-source blockchain with smart contract functionality.

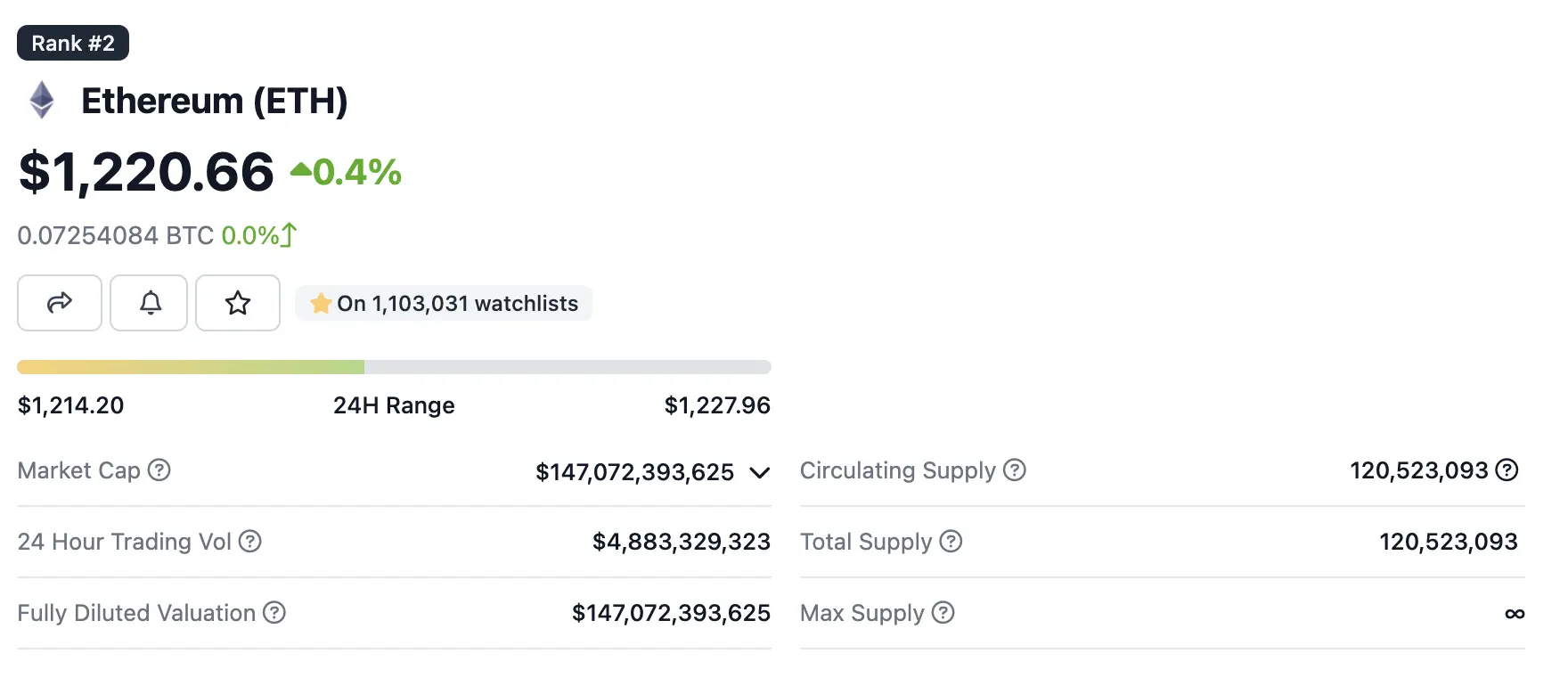

Ether ($ETH) is the native cryptocurrency of the platform. After Bitcoin, it is the second largest cryptocurrency by market capitalization, according to Coingecko.com.

The price per Ether token asset as of December 23rd, 2022 (provided by Coingecko).

Ethereum was invented in 2013 by programmer Vitalik Buterin. In 2014, development was crowdfunded, and the network went live on 30 July 2015.

Buterin initially described Ethereum in a whitepaper, and argued to the bitcoin core developers that Bitcoin and blockchain technology could benefit from other applications besides money. In order for this to happen, it needed a more robust language for application development that could lead to attaching real-world assets, such as stocks and property, to the blockchain.

In 2013, Buterin briefly worked with eToro CEO Yoni Assia on the Colored Coins project and drafted its whitepaper which outlined additional use cases for blockchain technology. However, after failing to gain agreement on how the project should proceed, he proposed the development of a new platform with a more robust scripting language.

This programming language would be Turing-complete. This was the initial birth of what would eventually become Ethereum.

The initial Ethereum development team

Ethereum was announced at the North American Bitcoin Conference in Miami, in January 2014. During the conference, Gavin Wood, Charles Hoskinson, and Anthony Di Iorio, who financed the project, rented a house in Miami with Buterin to develop a fuller sense of what Ethereum might become.

Ethereum allows anyone to deploy permanent and immutable decentralized applications onto it, with which users can interact. Decentralized finance (DeFi) applications provide a broad array of financial services without the need for typical financial intermediaries like brokerages, exchanges, or banks, such as allowing cryptocurrency users to borrow against their holdings or lend them out for interest.

Ethereum also allows for the creation and exchange of NFTs, which are non-interchangeable tokens connected to digital works of art or other real-world items. These may be sold as unique digital property.

Additionally, many other cryptocurrencies operate as ERC-20 tokens on top of the Ethereum blockchain and have utilized the platform for initial coin offerings.

The ERC-20 Protocol

The ERC-20 (Ethereum Request for Comments 20), proposed by Fabian Vogelsteller in November 2015, is a Token Standard that implements an API for tokens with “Smart Contracts”.

The ERC-20 protocol’s smart contracts provide functionalities like to transfer tokens from one account to another, to get the current token balance of an account and also the total supply of the token available on the network. Besides these, it also has some other functionalities like those that approve some amount of token from an account can be spent by a third party account.

If a smart contract under the ERC-20 protocol implements the following methods and events it can be called an ERC-20 Token Contract. Once deployed, it will be responsible to keep track of the created tokens on Ethereum.

Essentially, Ethereum tokens are smart contracts that make use of the Ethereum blockchain.

ERC-20 protocol: Smart contracts

Smart contracts are an essential component of the Ethereum blockchain, and they can be used to automatically enforce rules via code. To interact with a smart contract, users need a crypto wallet or hardware wallet to send transactions that execute a function defined by the smart contract. It’s important to note that smart contracts are not controlled by a user and can not be deleted by default. Therefore, it’s crucial to use a cold wallet or hardware wallet to securely manage your Ethereum accounts and interact with smart contracts. Additionally, when deploying a smart contract, users need to pay gas fees which can be significantly higher than the fees for a simple ETH transfer.

NFTs on the Ethereum blockchain

Another type of token that also uses smart contracts is called non-fungible tokens, also known as NFTs.

NFTs are tokens that we can use to represent ownership of unique items. They let us tokenize things like art, collectibles, eand ven real estate.

The Ethereum asset protocol used for non-fungibles are most often ERC-721 and ERC-1155. The biggest differences here pertain to batch transfers and transaction efficiency/cost.

They can only have one official owner at a time and they’re secured by the Ethereum blockchain. No one can modify the record of ownership or copy/paste a new NFT into existence.

An NFT is digitalized and coded in the same way as its done with a token asset. An NFT is also not duplicable and retains all of its transaction history. You can tell who has owned that specific NFT and how many times it has been traded before.

Because of this, you can easily prove if you created the NFT, or if you are the current owner of the NFT!

NFTs may also be set up with royalties. If you are the creator of an NFT, you can receive royalties every time it gets traded in the future.

DeFi on the Ethereum blockchain

Decentralized finance, or DeFi, refers to an alternative financial infrastructure built on top of the Ethereum blockchain.

DeFi uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, and transparent way. A smart contract can hold funds and can send/refund them based on certain conditions and it will always run as programmed.

DeFi thus provides services that don’t need intermediaries! How is that different from the traditional finance world, you ask?

In today’s financial world, financial institutions act as guarantors of transactions. This gives these institutions immense power because your money flows through them.

In the case of DeFi, these powers are given back to the ordinary people. This was Buterin’s original intention–to correct the imbalance and to “empower the little guy”.

Accessing the ERC-20 protocol on SecuXess

Ethereum is the second largest cryptocurrency by market capitalization, and its ERC-20 protocol is currently the most widely used token protocol in the world.

If you need help adding ERC-20 tokens to your Ethereum account token list, please refer to our step-by-step guide.

Have any other questions? Contact us today!